When a business receives a vendor invoice, that transaction goes through accounts payable. This process requires trust and credit, so you need a reliable system for tracking invoices and paying bills.

Effective management of accounts payable enables a more accurate record of your organization’s cash flow, strengthens vendor relationships, and creates opportunities for cost savings.

Paying your vendors, suppliers, and other partners on time is the key to doing good business. By keeping track of your accounts payable, you will understand your company’s cash flow, collect crucial data for better financial reporting, and avoid amassing too much debt.

One of the best ways to keep track of modern commerce is through accounts payable automation software. AP automation is sweeping the globe, offering up advantages like stronger tax compliance, self-service supplier management, and a streamlined approval process.

The accounting software market is set to grow at a CAGR of 8.5% by 2027, so it’s likely your competition is already taking advantage of the technology.

In this guide, we’ll examine everything you need to know about accounts payable, from how the process works to examples of accounts payable, common job roles in 2024, and tools for automation.

What is Accounts Payable?

Accounts payable (AP) are the debts owed to vendors and suppliers (recorded on a company’s balance sheet) to which the company has received goods or services purchased on credit, but hasn’t paid the supplier. Your company’s accounts payable balance is the sum of all outstanding amounts not yet paid to vendors.

The term accounts payable (AP) describes both a business account and a department that handles invoices. It’s a form of accrual accounting that represents a specific account in the general ledger.

This liability account entails a company’s obligation to pay short-term liabilities to suppliers, vendors, or creditors. The full accounting entry of these transactions appears under current liabilities on a balance sheet.

How Does the Accounts Payable Process Work?

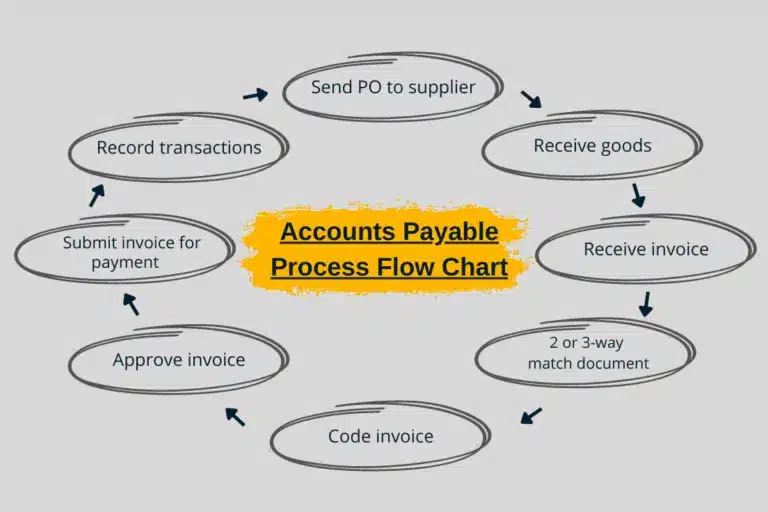

The AP department has a set procedure they must follow before releasing payments to vendors and creditors. These guidelines help to streamline transactions and create transparency to avoid document falsification or financial fraud.

For example, Company A needs to buy new manufacturing equipment, so they issue a purchase order for $20,000. Once the owner, CFO, or an employee with financial responsibility approves the purchase requisition and the procurement department or owner approves the PO, Company A places the order with a vendor.

The vendor sends an invoice for $20,000 that is then recorded in accounts payable. The AP team reviews the invoice to verify that the information is accurate and that the company received the correct order. After the invoice is approved, the AP team will send payment in full, or in part, as per the agreement with the vendor.

As business relationships grow over time, all terms and conditions must be clear. A reliable accounts payable workflow establishes brand trust and strengthens collaboration.

The AP process involves invoice management in these steps:

- Receiving invoices

- Verifying invoices

- Making payments

- Updating records

Receiving Invoices

When a company purchases goods or services, the AP team receives an invoice. This helps them keep track of quantity, current pricing, dates, and other essential details of the transaction.

When an accounts payable team lacks digital resources, the invoice data must be input into an accounting system. If you’re using AP automation software, the invoice is scanned with a process known as optical character recognition (OCR).

Verifying Invoices

The validation of all invoice data is critical, so your company only pays legitimate bills.

The accounts payable department uses supporting documents like the purchase order, quote, and delivery receipts to verify that the invoice is accurate. Other important details include:

- Vendor name

- Billing address

- Due date

- Authorization

- Compliance

AP software typically expedites this process and sends invoice approvals to the appropriate parties.

Updating Records

Once the company has received all invoices, the AP department must keep the records current by adding debits and credits to the correct accounts. This is also referred to as double-entry bookkeeping.

Depending on a company’s operating policies, updating records requires management approval to keep the process transparent at every touchpoint.

Making Payments

The accounts payable department is responsible for making timely payments to all suppliers, creditors, and supply chain partners. The team prepares and reviews the necessary documents and designated managers approve invoices before initiating payment.

To ensure everything is running smoothly, CPA firms conduct an annual audit of financial statements including documents like your company’s balance sheet, cash flow statement, income statement, etc.

How to Record Accounts Payable

Accounts payable represents a key journal entry in accounting, which is used to record business transactions. Journal entries address different financial situations over a period of time. For accounts payable, it’s a two-step process:

- Debit the asset or expense account related to the purchase (i.e. inventory, services, etc.)

- Credit the accounts payable bank account

When an accounts payable is paid, the AP department then debits the accounts payable account and credits cash.

Accounts payable is always included on a business balance sheet, and since it is considered a liability, the money owed to creditors is listed under “current liabilities.” These are usually short-term expenditures that last less than 90 days.

Accounts Payable in Accounting

Accounts payable is a form of accrual accounting that requires double-entry bookkeeping. Unlike cash-basis accounting, accrual recognizes that debts are not always paid right away, and must be recorded and tracked as accounts payable or another liability.

In this case, supplier invoices are recorded as debits for inventory and fixed assets on your company’s balance sheet. Or, they are recorded as expenses on the income statement and the accounts payable entry, adding the supplier invoice as a credit.

The amount payable is primarily an IOU (short-term liability) from one company to another. The creditor will record the transactions in their general ledger as an asset.

At any given time, the AP balance appears in the current liabilities section of the balance sheet. It is the responsibility of the company to pay off this short-term debt within a specific time frame to avoid financial defaults and late payments.

Below are four other responsibilities of accounts payable:

Cash Flow Management

Accounts payable reflects how quickly a business is paying down debt. Your cash flow is important when growing a business. There are two expected scenarios with AP:

- Your company’s AP increases: This means that management is making more purchases on credit than paying cash or delaying payments.

- Your company’s AP decreases: This means that the company is paying off debt faster or purchasing less on credit.

Managing a liability account is vital for positive cash flow throughout the year. Companies strive to keep good cash flow by paying off AP as quickly as possible. This is to avoid accruing interest or late fees and to earn early payment discounts.

Early Payment Discounts

Some suppliers provide early payment discounts if a company settles an invoice sooner than the due date. Some vendors include the payment term “1/10, n/30” in their invoices. This means that buyers who pay within 10 days, instead of waiting until the due date, are entitled to a discount of 1% on the amount of money owed.

Other suppliers offer more significant discounts, such as a “2/10, n/30” payment term. Buyers who remit the amount owed within 10 days may get a 2% discount on the amount owed.

Accounts Payable Turnover Ratio

The rate at which your company settles its accounts payable in any given time period is your accounts payable turnover ratio. The ratio is determined by dividing your company’s total amount of supplier purchases on credit by the average accounts payable.

For example, if Company A’s total supplier purchases, with credit terms, amount to $60,000 and the average accounts payable is $4,000, Company A’s accounts payable turnover is 15 times per year.

A high turnover ratio means a company pays its bills in a short period of time. In contrast, a lower turnover ratio could suggest that a business is struggling to pay its invoices, although this isn’t always the case.

Long-Term Notes

If a company is behind on a payment, a business owner can ask the vendor to reclassify the account payable as a long-term note. This payment term is for accounts due in 12 months or more. The debt should no longer reside in a short-term expense account.

Typically, long-term notes involve an added interest payment. Whether a vendor agrees to a long-term note depends on the company’s relationship with the vendor.

Accounts Payable vs. Accounts Receivable

Accounts receivable is the opposite of accounts payable. Accounts receivable (AR) is a current asset account that tracks the money that is owed to your company, usually from customers for your goods and/or services.

When your company, which will be the payer, makes a credit transaction, it records an entry to accounts payable, while the payee records an entry to accounts receivable.

Accounts Payable vs. Trade Payables

Although these terms are used interchangeably, they are slightly different scenarios. Trade accounts payable or trade payables is the money that you owe your vendors for inventory-related expenses, like office supplies or inventory materials. Trade payables fall under accounts payable, and some companies simply combine the two into one accounts payable process.

Some examples of trade payables include:

- Raw materials purchased by manufacturers

- Ingredients purchased by restaurants and cafes

- Clothing sold by retailers

- Parts purchased by automotive manufacturers

Anything that a company needs to keep operations running is considered direct spend.

Examples of Accounts Payable

The accounts payable process is found across many industries. Here are a few examples of accounts payable scenarios that you might encounter:

- Utilities

- Equipment

- Subcontractors

- Production materials

- Subscription or installment payments

The AP department has a wide variety of responsibilities beyond managing vendor invoices. In large companies, accounts payable is its own department; in smaller companies, accounts payable and accounts receivable are often combined. Regardless of the company’s size, the AP department performs these critical tasks:

Travel Expenses

Companies often require teams to travel for business, and the AP department manages the payment process for these expenses. Depending on company policy, the department may process reimbursement requests and handle meal expenses for employees when they travel.

Upon the employee’s return, the AP department accounts for the funds (typically through an expense report submitted by the employee) and settles all reimbursement claims.

Internal Payments

The AP department is responsible for managing internal payment reimbursement such as:

- Distribution control

- Petty cash

- Office supplies

- Sales tax exemption certificates

Petty cash covers minor expenses such as lunches and transportation.

The AP department also handles the tax exemption certificates issued to managers to ensure that sales tax is not added to business purchases.

Vendor Payments

The department must manage contact information for various vendors, Form W-9, payment terms, and more. In accordance with the company’s internal policies, the AP department either oversees pre-approved purchases or verifies the procurement after it has been made.

In addition to these activities, the department also manages a month-end due date report that shows the company’s current outstanding balances. This is called an accounts payable aging report and can be used to collect past-due payments.

Cost Optimization

To remain competitive in the industry, companies need to reduce expenses to improve cash reserves. The finance and AP teams will devise strategies to increase profitability without taking on excessive debt.

Since AP is the point of contact for suppliers, they can also offer discounts to build long-term business relationships. These strategies are mutually beneficial for both parties and help a company grow.

Internal Controls

A company’s cash and assets must be safeguarded, which is why internal controls within the accounts payable process are critical.

Internal controls prevent the company from:

- Paying inaccurate and fraudulent invoices

- Paying a vendor twice

- Paying without ensuring that all invoices are accounted for

To avoid errors and fraud, a business may implement checks and balances, like:

- Segregation of duties: Ensures that no one employee can single-handedly prepare and approve a payment

- Separation of procedures for registering new vendors and entering vouchers: Guarantees that an employee cannot register themselves as a vendor and pay themselves without approval from other employees

- Addition of vouchers: Certifies an approval procedure’s completeness

Internal controls involve critical tasks for the accounts payable department.

Common Job Roles and Responsibilities in Accounts Payable

There are over 400 different job titles and roles for accounts payable in the United States. What are some more common ones?

- Accounts Payable Specialist

- Billing Specialist

- Accounts Payable Associate

- AP Clerk

- AP Coordinator

- Accounts Payable Accountant

When it comes to AP responsibilities, it runs the gamut depending on factors like industry, company size, inventory, etc. Here are some of the more well-known AP responsibilities that are shared across all business sectors:

- Review all invoices and ensure they’re matched with the appropriate documents

- Perform data entry for the general ledger

- Execute bank account and credit card reconciliation

- Obtain approval from appropriate parties

- Assist senior financial officers as needed

Sometimes, accounts payable teams are also responsible for generating purchase orders. It simply depends on the structure of the business.

Check out these 6 simple steps to get started with AP automation right now.

Take Control of Your Accounts Payable with Automation

The accounting process is highly subject to human error, especially during manual data entry. Paper invoices also cause problems because documents can get lost or duplicated. Such issues result in high metrics for cost-per-invoice. That’s why companies are turning to accounts payable automation to streamline AP business processes.

Tipalti is accounting software that can help a business of any size implement AP automation. The system enhances the AP process and provides services like:

- Touchless invoice processing: Tipalti has built-in optical character recognition (OCR) technology supported by layers of machine-learning algorithms to scan, capture, and process invoice data effortlessly.

- Software designed for two-way and three-way purchase order (PO) matching: Tipalti simplifies PO automation, eliminates overspending, and strengthens a company’s financial controls.

- Tipalti Pi℠: Tipalti’s integrated payables intelligence platform is designed to enable controllers to proactively reduce process risks and errors.

- Tipalti Detect™: Tipalti’s integrated fraud management solution prevents fraud and mitigates risk. Tipalti offers detailed payee monitoring and tracks a wide variety of data points to uncover potential fraudsters.

- Enhanced vendor and supplier management: Tipalti’s integrated supplier hub streamlines manual data entry by shifting the work of collecting and maintaining accurate vendor data to suppliers.

- Payment reconciliation and cost savings: Forgo stitching bank statements and spreadsheets to reconcile payments. This feature speeds up financial close, thereby reducing costs.

No matter how much we automate, AP will always require a human touch.

Accounts Payable FAQs

Is accounts payable a debit or credit?

All accounts payable is considered a liability. These transactions are generally recorded as a debit on a company’s balance sheet. However, if a business makes early payments or pays more than the balance, it can also be recorded as a credit.

Where do you find a company’s accounts payable?

Accounts payable is listed on the balance sheet since it is considered a liability. The money that is owed to creditors is listed under the “current liabilities” section, which is typically short-term and 90 days or less.

Is accounts payable a hard job?

Depending on where you work, accounts payable can prove to be quite a difficult job. A short time frame to make payments doesn’t leave much room for mistakes, including ones made outside of AP.

Yet, the AP Clerk is responsible no matter what errors occur. The role carries a lot of accountability and requires a high level of focus.

Summing it Up

AP and cash management professionals are vital assets for a business, helping to ensure financial stability every step of the way.

Accounts payable is a key function for keeping a business afloat. It’s a financial process that involves accepting invoices, verifying them, making payments, and recording the data.

However, a disorganized AP department faces many challenges. When vendors are not paid, it strains relationships, slows down the supply chain, and eliminates opportunities for discounts.

A paper-based AP process crawls at a snail’s pace compared to accounts payable automation. It truly is the wave of the future with automated controls for approval, OCR scanning, multi-payment processing, vendor management, and so much more.

Whether you run a small business or a large operation, accounts payable automation software will bridge the gaps in your workflows leading to happier suppliers, more motivated employees, and a clearer picture of financial health. Get started with your own AP automation today.