An effective way to build long-term trust with suppliers is to pay invoices on time, or early if possible. It’s a worthwhile investment that can benefit both you and your suppliers’ business goals and provide leverage for negotiating contracts.

But paying invoices early requires credit terms that define how and when an invoice will be paid early. More often than not, suppliers offer early payment discounts.

This is where the credit term of a 2/10 net 30 comes in.

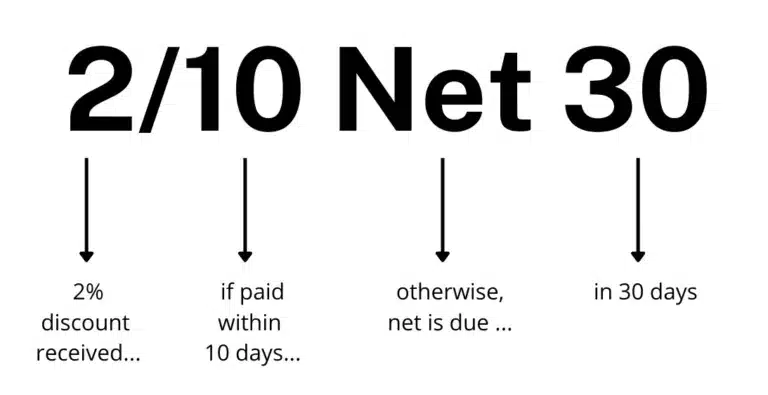

What is 2/10 net 30?

2/10 net 30 is a trade credit extended to the buyer from the seller. A buyer will receive a 2% discount on the net amount if they pay the invoice in full within the first ten days of the invoice date. Otherwise, the full invoice amount is due in 30 days without a discount. These terms are specific to the 2/10 net 30 discount.

2/10 net 30 Explained

A purchase order and related invoice state the terms of a transaction. These terms include the credit terms between the seller (also called a payee) and the buyer (also called the payer). A typical net 30 credit term means the balance is due within 30 days from the invoice date.

A 2/10 net 30 (also known as 2 10 net 30) means the balance will be discounted by 2% if the buyer makes a payment within the first ten days. So the “2” represents the discount amount (2%) and the “10” represents the due date (10 days out).

How do you calculate 2/10 net 30?

For example, if your business purchases $500 worth of goods or services on June 1st, it has entered a credit agreement with the seller. If your business pays the net amount between June 1st and 10th, you’ll receive a 2% discount, which will bring your total down to $490.

Let’s walk through this 2/10 net 30 example step-by-step:

- Invoice full amount: $500

- Invoice date: June 1

- Invoice due date: 30 days

- Payment terms: 2/10 net 30

- Discount period: 10 days

Begin counting days from the invoice date.

A quick formula is 100% – discount % x invoice amount.

100% – 2% = 98% x $500 = $490.

Formula:

(Term Discount) x (Invoice Amount) = Reduced Payment

Formula with Factors:

(0.02) x (500) = 490

This means your business would save $10 for a total payment of $490 if you paid between June 1st – 10th.

| Date of invoice payment | Number of days before paying | Early payment discount % | Discount amount | Payment amount due |

|---|---|---|---|---|

| June 1 through June 10 | 0 – 10 | 2% | $10 | $490 |

| June 11 through June 30 | 11 – 30 | 0% | $0 | $500 |

Accounting for Discounts: Net Method vs Gross Method

The difference between the net method vs gross method of recording invoices with the option of taking early payment discounts is that the net method records the invoice at the discounted amount, whereas the gross method records the invoice at full invoice amount without subtracting the discount amount offered for early payment.

These gross vs. net methods in accounting for invoice discounts also apply to the option of paying a smaller amount when paying in cash for an optional cash discount.

Net method early payment discount example

As an example, you company could choose to use the net method of recording purchases on an invoice with 2/10 net 30 discount payment terms. The full amount of the invoice is $500, but the 2% discounted amount of the invoice is $490 if payment is made within 10 days.

In this net method of accounting by a customer that plans to take discounts as an accounting policy, the company records the supplier invoice at its discounted amount of $490 as a credit to accounts payable and $490 as a debit to the purchases or inventory account. When your accounts payable team promptly pays the invoice within 10 days, earning the discount, credit cash for $490 and debit accounts payable for $490 using the accounts payable system.

If the invoice is paid timely within 10 days to earn the discount after recording the invoice with the net method, no additional 2/10 net 30 journal entry adjustments are required.

But if your company doesn’t actually take the early payment discount, upon payment after the initial 10 days for earning a discount, prepare and record the transaction to include an adjusting purchase discount journal entry.

The accounts payable system was set up to credit cash for $490 and debit accounts payable for $490 upon payment. Credit cash for an additional $10 to equal $500 total paid and debit purchase discounts lost for $10.

Gross method early payment discount example

As an easier option for initial recording if your company doesn’t consistently take early payment discounts as a customer, use gross method accounting for early payment discounts.

Record the invoice at the full invoice amount due, with a debit to purchases or inventory of $500 and a credit to accounts payable of $500. If your company later decides to take an early payment discount, then make an adjusting purchase discount journal entry by crediting cash for $490, debiting accounts payable for $500 and crediting $10 to purchase discounts taken, which offsets the total purchases or inventory account.

What are buyer-initiated early payment programs?

A buyer-initiated early payment program is managed through accounts payable with either the dynamic discounting method or supply chain finance method.

When the seller doesn’t offer cash discounts for prompt payment, buyers can negotiate for an early payment discount. If buyers propose a beneficial offer, sellers will accelerate their cash flow by accepting. And buyers would reduce spending.

Dynamic Discounting Method

Dynamic discounting describes when buyers initiate an early payment offer on an invoice-by-invoice basis with varying discounts. The buyer could offer a 2 percent discount to one seller and a 1.3 percent discount to another. Buyers adopting dynamic discounting can leverage their excess cash.

Supply Chain Method

With the supply chain finance method, the buyer borrows funds from a trade credit financer to pay the invoice under the early payment credit term, such as 2/10 net 30. The buyer will need to pay back the third-party bank or other financial institution since this method is essentially a loan. This corporate finance technique provides flexibility when cash balances are low.

What are some other trade terms like 2/10 net 30?

These payment terms on vendor and supplier invoices are defined in a similar way to 2/10 net 30:

2/10 net 45

2/10 net 45 means a 2% early payment discount if a customer pays within 10 days. Otherwise, the total amount is due within 45 days of the invoice date.

3/10 net 30

3/10 net 30 means a 3% discount if a customer pays within 10 days. Otherwise, the total amount is due within 30 days of the invoice date.

3/20 net 60

3/20 net 60 means 3% discount if a customer pays within 20 days of the invoice date. Otherwise, the net amount is due within 60 days of the invoice date.

2/EOM net 45

2/EOM net 45 means a customer receives a 2% early payment discount if they pay by the end of the month (EOM). Otherwise, the net amount is due 45 days after the invoice date.

Net 20 EOM

Net 20 EOM means the total amount is due for full payment within 20 days after the end of the month.

On credit sales, vendors offer a 2 percent discount most often to customers. Some vendors charge interest or financing charges on overdue bills per invoice terms.

When implementing an early payment program with either the dynamic discounting or supply chain finance method, companies will find it’s easier said than done. The rub lies in the efficiency of the accounts payable workflow. Businesses that have manual accounts payable processes will face these common challenges regarding early payment discount:

- Lengthy invoice approval process: the time between receiving the invoice to approving the invoice is often outside the timeframe of the of 2/10 net 30, which prevents the buyer from taking advantage of the discount.

- Lack of data: buyers must negotiate an offer that’s attractive to the seller and makes a difference in the company profit margin. In other words, the discount needs to be mutually beneficial. Finding that sweet spot takes visibility into several variables: buyer hurdle rate, discounting liquidity constraints, availability of third-party financing, and more. Manual accounts payable processes make it hard for companies to have deep visibility into these variables across all vendors.

- Weak buyer-seller relationship: implementing an early payment program takes adoption from both the buyer and the seller. Building the relationship between accounts payable and the seller can be challenging if the only contact occurs during the onboarding process when sellers submit tax documents. The lack of real-time visibility into the status of a payment hinders the buyer’s ability to give an accurate timeframe for payment delivery, which can affect the seller’s attitude and trust toward joining an early payment discount program.

Pros of 2/10 Net 30

The pros of 2/10 net 30 are that when the early payment discount is earned, the buyer pays 2% less for its purchases of goods and services, reducing the cost of goods sold, other expenses, and cash used. And the seller speeds up accounts receivable collections of credit sales, improving cash flow.

Your company’s financial statements, including the balance sheet, income statement, and statement of cash flows, will improve when your company takes early payment discounts. Supplier relationships will improve, and you can expect continued shipments of products. Paying bills early or on time contributes to a healthy credit score.

The CFO and the finance term contribute to business results when they optimize taking 2/10 net 30 and other attractive discount terms.

The seller may reduce bad debts when it increases early collections. Sellers offering 2/10 net 30 discount terms attract more new customers who consider the early payment discount term to reduce their total product or service price.

Cons of 2/10 Net 30

Cons of 2/10 net 30 are that sellers receive 2% less cash from credit sales carried as accounts receivable when the credit term of 2/10 net 30 is offered to its customers and they pay within the early payment discount period.

Although accounting software calculates early payment discounts for invoices, sellers may need to do a little more bookkeeping to record customer discounts when actually taken.

Should a Company Take Advantage of 2/10 Net 30?

A company should take advantage of 2/10 net 30 early payment discounts if they have sufficient cash flow or access to financing like a short-term line of credit or supply chain method financing from providers. The buyer should compare any interest rate to the opportunity cost of not taking the discount.

Paying invoices promptly to apply discount terms reduces cash needed and improves profitability shown on the income statement.

What is 2/10 Net 30 Annualized Interest Rate?

The 2/10 net 30 annualized interest rate is calculated as 36.7%.

Compare this 2/10 net 30 annualized interest rate to your bank’s annual interest rate for financing, which is generally much less.

As an example, if the invoice amount is $500, calculate the 2/10 net 30 annualized interest rate:

$500 x (100% – 2%) = $500 x 98% = $490

($500/$490) – 1 = 2.04% for the 20 days between day 10 and day 30

Annualize 2.04% for one year:

360 days ➗ 20 days = 18 times per year

2.04% x 18 = 36.7% annualized

The calculation works the same and provides the same result for any vendor invoice amount.

Your business can justify taking the 2/10 net 30 early payment discount if you have adequate cash or can tap into financing at a lower rate to provide the required money for prompt vendor invoice payment.

A second decision is to compare the 2/10 net 30 annualized interest rate to your company’s WACC (weighted average cost of capital) rate or actual anticipated project returns. You can determine if you should invest in other company projects with higher rates of return instead. (The WACC often defines the hurdle rate of minimum percentage returns required on company projects.)

Although they’re not consistently enforced, some vendors have terms that impose an interest-based fine on late payments by customers. Avoid late fees.

When to use the 2/10 Net 30 early payment discount

Taking a 2% early payment discount offered by the seller by paying vendor invoices for goods or services purchased on credit within 10 days of the invoice date makes sense when a company has enough internally-generated cash flow or access to financing.

Small businesses and larger companies have access to bank lines of credit and supply chain financing. Startups and growing businesses have cash resources provided by venture capital.