In current economic conditions of inflation, supply chain disruptions, and logistics delays, supplier power in an industry has magnified importance in determining their customers’ profitability and production capability. Businesses take a strategic approach to managing their competitive capabilities and cost structure by analyzing and responding to the bargaining power of suppliers, one of Michael Porter’s Five Forces. And they increase their own bargaining power as a supplier to their customers.

This article goes beyond definitions for the meaning, examples, and strategies by offering practical solutions for handling supplier relationship management. Automation software tools cover procurement processes and cost-effectively paying global vendor invoices using automation software.

What is the Bargaining Power of Suppliers?

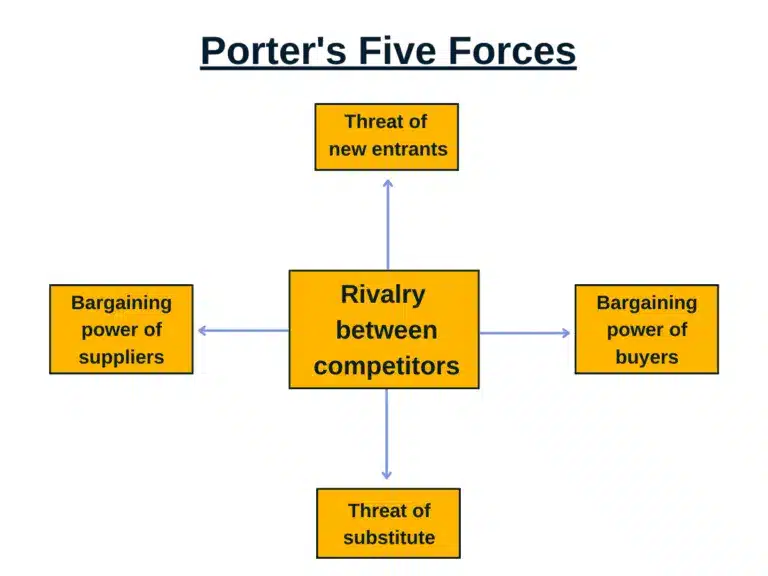

The bargaining power of suppliers is one of Porter’s Five Forces, and is the concept that suppliers can apply pressure to companies by lowering product quality or availability, or raising product prices.

Bargaining power of suppliers in an industry is strong or weak, shown by their ability to charge higher prices or get better terms when negotiating with customers. The strength of suppliers impacts industry supplier and customer profitability. Factors influencing the bargaining power of suppliers include availability of alternative suppliers, substitute products and ease of switching suppliers.

The bargaining power of suppliers is one of Harvard Business School professor Michael E. Porter, Ph.D. ‘s five forces business model, first published in a classic 1979 Harvard Business Review article and comprehensively explained in his book, Competitive Strategy.

Importance of Porter’s Five Forces

Porter’s Five Forces is an important industry analysis that established businesses should perform to improve their competitive position. Startups should use this competitive forces analysis to select an industry with less competition and fewer barriers to entry. Using Porter’s Five Forces model as a strategic tool can increase your company’s profitability and bargaining power.

Porter’s Five Forces in an industry are:

- Rivalry among existing competitors

- Bargaining power of suppliers

- Bargaining power of buyers

- Threat of substitute products or services

- Threat of new entrants

Today’s strategic CFO needs to counterbalance supplier strength to the extent possible when negotiating and spending money on purchases. The business model should also increase its strength as a supplier to customers.

As a customer, supplier, and competitor understanding Porter’s 5 Forces, your business can gain power and competitive advantage by devising strategies and determining actions. Use strategic finance techniques to assess the relative bargaining power of industry suppliers, buyers, and competitors to optimize costs, profit potential, revenues, and market share to the extent possible in your industry.

The Relative Bargaining Power of Suppliers is Most Likely Low When…

The relative bargaining power of suppliers is most likely low when many suppliers in a competitive environment serve the industry and supply exceeds demand. Buyers can choose product substitutions, and the cost of switching suppliers is low. When supplier bargaining power is low, buyers may be able to obtain a bargain supply of goods at a lower price.

The Relative Bargaining Power of Suppliers is Most Likely High When…

The relative bargaining power of suppliers is most likely high when the number of suppliers competing in the industry is few, product differentiation and product demand are high, product substitutions aren’t available, and the cost of switching suppliers is high.

When the bargaining power of suppliers is high, buyers will pay more in industries with price sensitivity. Contract and invoice terms offered by suppliers may be less generous.

Example of Bargaining Power of Suppliers

Consider the following bargaining power of suppliers example from the energy industry, including determining factors.

The petroleum manufacturing industry in energy, known as oilfield services, is a competitive industry with major multi-product suppliers organized by decentralized subsidiary units. Suppliers in the oilfield services industry include major players Baker Hughes, Schlumberger, and Halliburton, and smaller suppliers that sell products and services to oil & gas exploration companies, refiners, and pipeline companies.

Oil & gas prices, which fluctuate with changing supply levels, influence industry supply and demand.

Unless these oilfield services suppliers offer a particular product not offered by their competitors, oil & gas customers will face moderate-strength industry suppliers in a stable market. There are at least three formidable suppliers in the oil & gas industry, which is less than one or two controlling the industry. Because these suppliers offer differentiated products rather than commodities, they aren’t considered weak suppliers.

However, if these customers have extensive purchasing history of products with a supplier or the goods are custom-made, the cost of switching from one supplier to another for certain products may be high, increasing the bargaining power of the supplier.

Product substitution is probably unlikely unless new technology makes this possible.

In this example, the buyer may find a bargain supply offered by suppliers in this highly cyclical industry if the industry is experiencing a cycle of high supply and low demand, which decreases the bargaining power of suppliers.

How can your business improve its bargaining power with suppliers?

Download our white paper, “How to Streamline Supplier Onboarding” to learn how your growing business can better communicate with, track spending volume, and cost-effectively pay its global suppliers.

Use AP automation software with self-service supplier onboarding, efficient automated invoice processing for taking timely supplier early payment discounts, spend management visibility, supplier payments tracking, and verification processes to simplify global regulatory and tax compliance and reduce fraud risk and errors.

Backward Integration Strategy

To create a competitive advantage, buyers may decide to adopt a backward integration M&A strategy. They do this by buying suppliers or supplier product lines in the value chain needed as raw material inputs and labor to manufacture their product outputs. If they purchase or merge with a supplier, they gain the bargaining power of a strong supplier or add strength and product quality to a weaker supplier.

When volume increases, economies of scale can reduce costs compared to buying from an independent supplier. The business will have first priority on the acquired products. And the company won’t be detrimentally affected by this supplier’s future price increases. For companies with an established global footprint as exporters or international sales and operations, market share can be gained by the combined entity.

Backward integration and forward integration are types of vertical integration by merger & acquisition. The types of suppliers in a supply chain determine whether the M&A is backward or forward integration. Forward integration is with suppliers serving as wholesalers or distributors, delivery, and retail sales or services after product manufacturing is complete. The threat of forward integration or backward integration of suppliers may influence industry competitiveness.

Automation + Supplier Relationship Management

Automation tools decrease your business workload for dealing with the bargaining power of suppliers in a five forces analysis. And they provide the following additional benefits.

To gain control over expenditures, increase efficiency, and improve supplier relationship management, businesses should use automation software. Automation is essential for growing companies with global expansion needing solutions for global supplier management and global supplier payments.

Five types of automation software related to suppliers are:

- Purchase order management automation

- Supplier relationship management software

- Spend management automation

- AP automation

- Global payments automation

Tipalti Approve offers a purchase order management solution for procurement management, handling purchase requests and purchase orders, approval workflows, and vendor onboarding.

Supplier relationship management software automates the online procurement process from submitting and responding to RFQ/RFP requirements, supplier vetting, strategic sourcing, real-time bidding auctions, contract management, and supplier scoring and reviews.

Spend management automation software may include extra modules performing the functions of procurement strategy, procurement cash flow forecasting, procurement analytics, and supplier relationship management. Spend management tracks expenditures by category and supplier.

AP automation software integrates with your ERP system or accounting software. Tipalti AP automation manages the end-to-end payables process, beginning with supplier onboarding and tax compliance through a self-service online supplier portal. Supplier communications and timely payments to earn early payment discounts improves supplier relationships and profit margins.

Accounts payable automation significantly improves efficiency by 80% and speeds financial close by 25%. AP automation eliminates manual processes and reduces error rates by 66% and fraud risk by using 26,000 global banking rules. It lets your business achieve global regulatory compliance.

Global payments automation software by Tipalti streamlines domestic and international supplier payment processes, providing cross-border payments to 196 countries in 120 currencies. It offers a choice of available payment methods and automatic payment reconciliation, including multiple payment types.

Conclusion

The bargaining power of suppliers is one of Porter’s Five Forces impacting competitiveness and profitability in an industry. The bargaining power of suppliers applies whether your company is a buyer or a supplier to its own customers.

High bargaining power of suppliers results from fewer competing industry suppliers, product or service differentiation, a lack of product or service substitutions for the buyer, and high switching costs. Low supplier bargaining power from competitive rivalry or lower demand relative to supply results in higher buyer power. It’s a buyer’s market with opportunities to avoid cost increases and save money.

When using purchase order management, procurement, and AP automation software tools your business is armed to mitigate business impacts from the relative strength of your suppliers. Download our summary of a Level Research independent study, “A Guide to Global Supplier Payments: Best Practices for Managing Cross Border Transactions.”